30 of the most frequently asked questions about buying property in Spain and on the Costa Blanca

- noagent

- Aug 2, 2025

- 9 min read

Updated: Oct 1, 2025

Purchasing a Property in Spain: Your Essential Guide to FAQs

=================================================================

Buying a property in Spain can be daunting. Many questions arise during the process. Here are 30 of the most frequently asked questions about buying property in Spain and on the Costa Blanca, along with their answers. We are here to help, and if you have a question that isn't on the list, we are happy to assist. All the information we provide is free and unbiased.

General & Legal Questions

1. Is it safe to buy a property in Spain?

Yes, buying property in Spain is safe as long as you follow the correct legal procedures. It is essential to hire an independent, bilingual lawyer ("abogado") who will conduct a thorough legal check on the property and ensure the sale is legitimate and free of any debts. Click here if you want to know more

2. What is a NIE number and why do I need one?

A NIE (Número de Identidad de Extranjero) is a tax identification number for foreigners. It is mandatory for any financial transaction in Spain, including buying a property, opening a bank account, paying taxes, and connecting utilities. Click here if you want to know more

3. Do I need a Spanish lawyer or notary?

You will need both. A lawyer is highly recommended to perform due diligence, verify the property's legal status, and draft contracts. The notary is a public official who legally certifies the final deed of sale (Escritura de Compraventa), ensuring the transaction complies with Spanish law.

Recommend independent lawyers iMont legal Click here if you want to know more

4. What is the difference between a new-build and a resale property?

Resale properties are pre-owned homes that offer established neighbourhoods, often come with gardens, and may be less expensive. They are typically available for immediate occupancy.

New-build properties are brand-new homes bought directly from a developer. They come with modern designs and amenities and usually have a 10-year structural warranty, but the construction process can take several months or years. Click here if you want to know more

5. How long does the buying process take?

The purchasing process, from the reservation contract to signing the final deed, typically takes 2-3 months for a resale property. For a new-build, it can be much longer, depending on the construction schedule. Click here if you want to know more

6. Do I need to get a property survey in Spain?

Unlike in some other countries, a formal property survey is not a standard part of the process in Spain. Your lawyer will check the legal status, but it is highly advisable to hire a private surveyor or architect to check the physical condition of the property to avoid unexpected repair costs. Click here if you want to know more

7. Can I get a mortgage as a non-resident?

Yes, non-residents can get a mortgage in Spain. However, the terms are different from those for residents. Banks typically lend a maximum of 60-70% of the property's valuation to non-residents, so you will need a larger deposit and to cover all purchasing costs. Recommend using an international broker who can view the whole market to get you the best deal.

Read our post on International Mortgages: Click here if you want to know more

8. What are the key documents I need to see before buying?

Your lawyer should check for a "Nota Simple" (a legal document from the Land Registry), which confirms the property's ownership, outstanding debts, and legal status. They should also verify the "Certificado de Empadronamiento" (proof of residency) and ensure all utility bills, taxes, and community fees are paid up to date. Click here if you want to know more

9. Are properties in Spain freehold?

Most properties in Spain, including on the Costa Blanca, are freehold (plena propiedad). This means you own both the building and the land it is built on. Apartments are typically owned as a share of the freehold, managed by a community of owners. Click here if you want to know more

Financial & Tax Questions

10. What are the total costs of buying a property on the Costa Blanca?

You should budget an additional 10-15% of the purchase price to cover all taxes and fees.

This includes:

Transfer Tax (ITP): 10% for resale properties.

VAT (IVA): 10% for new-builds, plus 1.5% Stamp Duty (AJD).

Notary and Land Registry fees: Approx. 0.5-1%.

Legal fees: Approx. 0.5-1%.

Read our post on purchase fees: Click here if you want to know more

11. What are the ongoing costs of owning a property in Spain?

Ongoing costs include:

Council Tax (IBI): An annual property tax based on the cadastral value.

Community Fees: If you own an apartment or a property in an urbanization with communal facilities (pool, gardens).

Non-Resident Income Tax: Non-residents who own property must declare and pay tax on the imputed rental income, regardless of whether it is rented out.

Utility bills (water, electricity, internet), and property insurance.

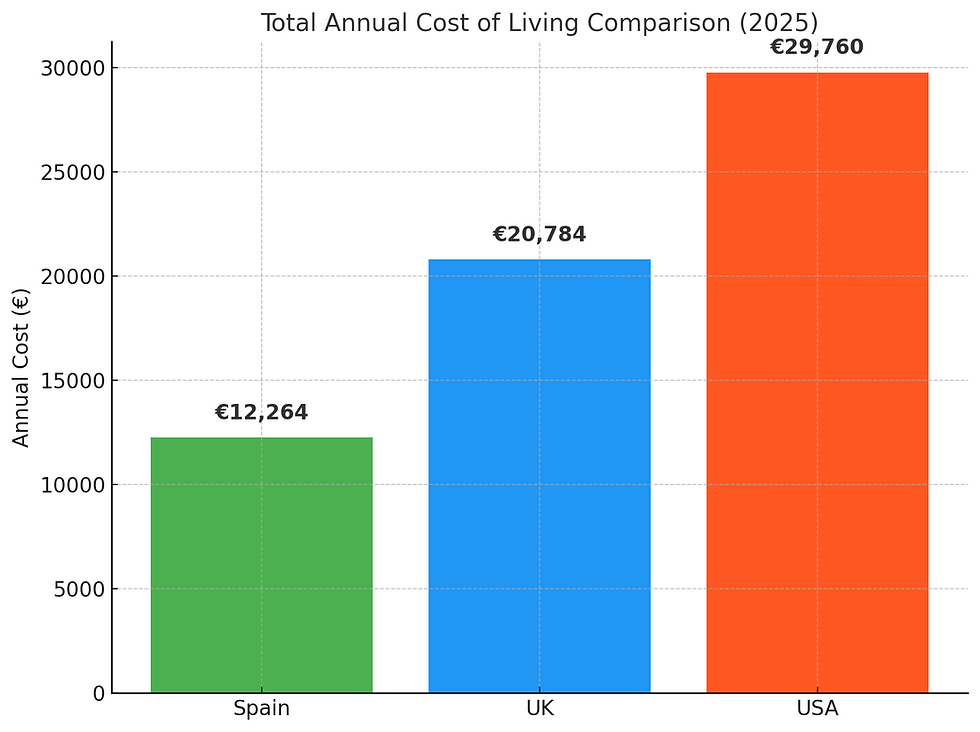

Read our post on the cost of living in Spain for more details: Click here if you want to know more

12. What is Capital Gains Tax in Spain?

Capital Gains Tax is a tax on the profit made when you sell a property. For non-residents, the rate is currently 19%. However, there are some exemptions, such as for residents over 65 who sell their main home and reinvest the proceeds into another main home. Click here if you want to know more

13. How does Brexit affect UK citizens buying property in Spain?

UK citizens can still buy property in Spain without special restrictions. However, as non-EU citizens, they are now subject to different rules for residency, visa applications for long stays, and higher tax rates on rental income.

Read our post on the different visas available: Click here if you want to know more

Practical & Lifestyle Questions

14. What are the best places to buy property on the Costa Blanca?

The "best" place depends on your lifestyle.

Popular options include:

Moraira & Jávea: High-end, picturesque, and popular with families and retirees.

Benidorm & Torrevieja: More affordable, lively, and popular for tourism and investment.

Altea & Calpe: Known for their charming old towns, beaches, and scenic views.

Orihuela Costa: A hub for golf, beaches, and a large expatriate community.

Read our post on all the different towns on the Costa Blanca Click here if you want to know more

15. Can I use my property for short-term rentals?

Yes, but you must comply with regional and local laws. In the Valencian Community (where the Costa Blanca is located), you need to obtain a tourist rental license for your property and adhere to regulations regarding guest registration, safety equipment, and taxes.

Read our post on renting out property in Spain: Click here if you want to know more

16. What is the Spanish Golden Visa?

The Spanish Golden Visa is a residency permit for non-EU citizens who make a significant investment in Spain, which includes purchasing real estate worth €500,000 or more. It allows you to live and work in Spain and travel freely within the Schengen Area. As of April 2025, this visa is no longer available.

Read our post on the different visas available: Click here if you want to know more

17. Do I need a Spanish will when I buy property in Spain?

It is highly recommended to have a separate Spanish will to deal with your Spanish assets. This simplifies the inheritance process for your heirs, saves time and money, and ensures your wishes are followed in accordance with Spanish law.

Recommend independent lawyers iMont legal Click here if you want to know more

18. How do I transfer money for the purchase?

You can transfer funds via a Spanish bank or use a foreign exchange specialist. The latter is often more cost-effective for large sums as they can offer better exchange rates and lower transfer fees. This is an important subject and one that should not be overlooked; you can save tens of thousands on the currency exchange.

Read our in-depth post on this important subject: Click here if you want to know more

19. What is the process for connecting utilities?

If the property is a resale, your lawyer or a "gestor" can help you transfer existing utility contracts (electricity, water, gas) into your name. For a new-build, they will assist you in setting up the new contracts with the relevant providers.

20. What is the difference between a "gestor" and a lawyer?

A lawyer (abogado) is a legal professional who advises on legal matters and protects your interests. A gestor is an administrative agent who helps with practical tasks like paying taxes, processing documents, and arranging utility connections.

Legal & Due Diligence Questions

Recommend independent lawyers iMont legal Click here if you want to know more

21. What happens if the seller of a property has debts?

In Spain, debts such as mortgages, local taxes (IBI), and community fees are often tied to the property itself, not the person. Your lawyer must conduct a thorough check to ensure all debts are cleared by the seller before the final signature at the notary. If not, you could inherit them with the property. The notary will also check this, but having your own lawyer is a critical safeguard.

22. How do I check if the property has illegal extensions or builds?

Your lawyer's due diligence should include a comparison of the property's description in the Land Registry (Registro de la Propiedad) and the Cadastre (Catastro) with its physical reality. Unregistered extensions or swimming pools can lead to fines, difficulties with future sales, or even demolition orders. A lawyer will verify that all construction is legal and properly registered.

23. What is a "Power of Attorney" and when would I need one?

A Power of Attorney (Poder) is a legal document that authorizes a trusted person (typically your lawyer) to act on your behalf. This is extremely useful if you cannot be present for every step of the buying process, such as opening a bank account, signing contracts, or completing the final deed at the notary.

24. What is a "Cadastral Reference" and why is it important?

The cadastral reference is a unique 20-character code assigned to every property by the Cadastre. This reference identifies the property's physical location, boundaries, and size for tax purposes. It is crucial to ensure that the cadastral reference on the deed matches the property you are buying and that the details are up-to-date.

25. What is the role of the Community of Owners?

If you buy an apartment or a property within a residential complex, you automatically become part of the Community of Owners (Comunidad de Propietarios). This body is responsible for managing and maintaining all communal areas, such as swimming pools, gardens, and lifts. You will be required to pay monthly or quarterly community fees and are expected to participate in the community's decisions. Your lawyer should confirm the community rules and check for any outstanding debts before you buy.

Post-Purchase & Ownership Questions

26. What happens immediately after signing the final deed?

After the deed is signed and the money is transferred, your lawyer will submit the document to the Land Registry for registration. You will also need to start the process of transferring all utility contracts (electricity, water, gas) into your name. This is a critical step that should be handled by your lawyer or a "gestor."

27. What are the rules for short-term rentals on the Costa Blanca?

The Valencian Community (where the Costa Blanca is located) has strict regulations for short-term rentals. You must obtain a tourist rental license (Licencia de Vivienda Turística) from the local authorities. The property must meet certain technical and safety requirements. In some cases, if the property is in a community of owners, you will also need to get a majority vote of approval from the community before you can rent it out.

28. What is the tax on rental income?

If you rent out your property, the tax rate on your rental income depends on your residency. For EU/EEA citizens, the tax is 19% on the net income (after deducting some expenses). For non-EU citizens, the rate is 24% on the gross income, with no deductions available.

Read our post on renting out property in Spain: Click here if you want to know more

29. What happens if I want to sell the property in the future?

When you sell a property in Spain, you will be liable for Capital Gains Tax on any profit. The buyer is also legally required to withhold 3% of the sale price as a retention against your Capital Gains Tax liability. Your lawyer will manage this process, including submitting a tax return to the Spanish tax authorities to either pay the balance or claim a refund.

30. Is the 100% TAX on property happening?

No, this is not happening; it is just an idea from the Prime Minister Pedro Sánchez. It has not been put to the government or parliament, and if it was, it is unlikely to pass.

If you have any questions, please do get in touch; we would love to help.